A Tip for Trading During a Bear Market (If you must...)

Bear markets are nothing new. They have been around since the beginning of trade. According to Investopedia, "A bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment." There are 2 general approaches one can take during a bear market. Each has pros and cons.

#1 Buy and Hold

This is the approach most recommended by experts. Why? Most people cannot predict when a bear market will happen and how long it will last. Trying to actively time a market can be pure folly. If you get it wrong, you will lose out on gains that you would have made. This is called "losing your position". 85% of active traders do not do as well as buy and hold traders. Think about that next time you get an urge to time the market. A quote from Abovethegreenline.com sums up buy and hold investing:

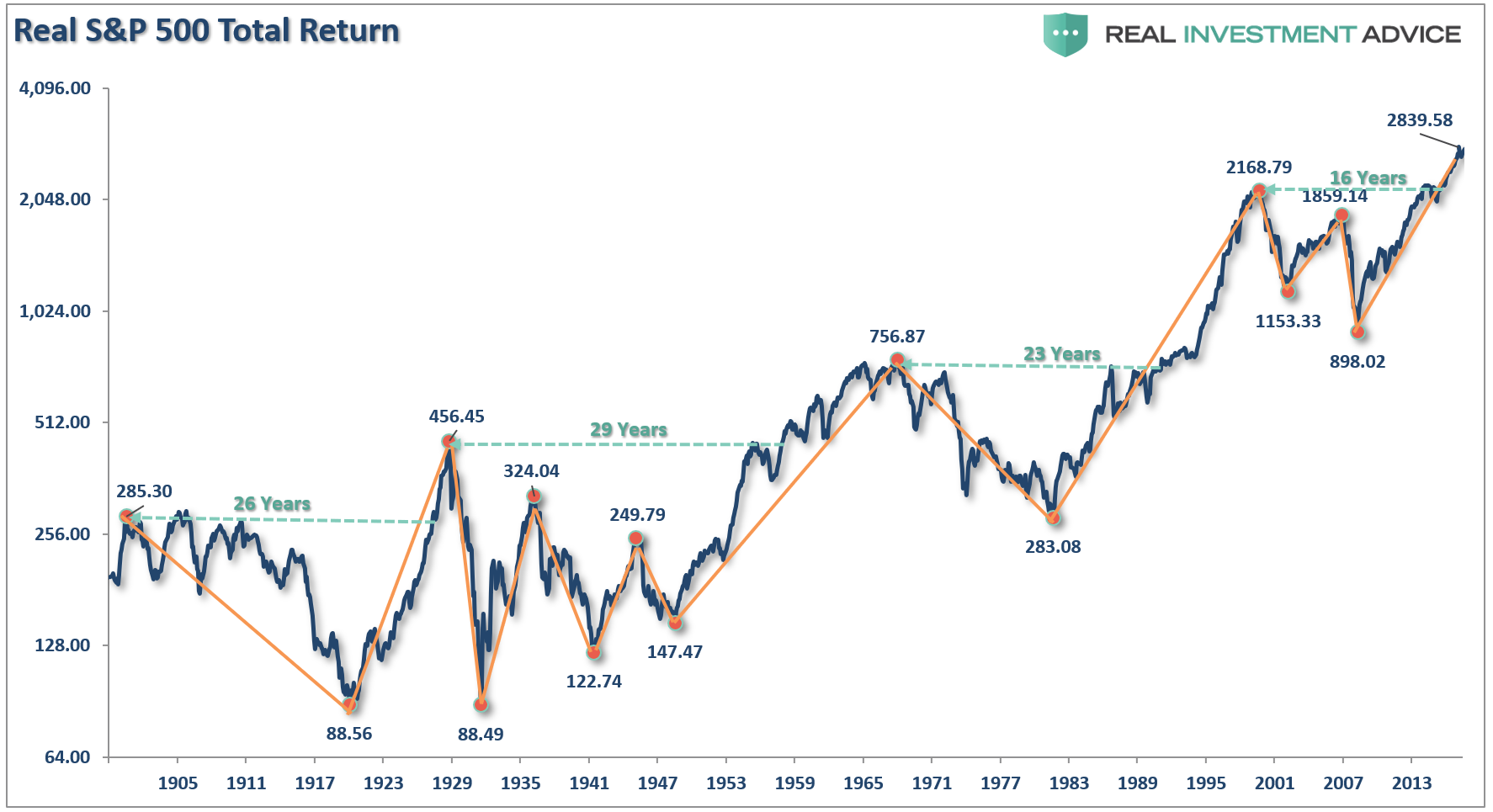

"Buy-and-hold investing, also known as passive management, varies greatly from market timing. Instead of predicting the right points to enter and exit the market, an investor employing a buy-and-hold approach selects securities or funds and then holds onto them long term with no focus on short term price fluctuations. It is generally thought that when employing this method one’s assets should not be needed for three to five years. Many investors are advocates of this method simply because it works. Since the buy-and-hold strategy is based entirely on fundamental analysis, there is no room for subjectivity."There is a problem with this approach however that many people do not acknowledge. Buy and hold does not always work! We sometimes forget that history is full of exceptions to the buy the dip rule in which the "dip" lasted for many years or even decades. See the chart below courtesy of "Real Investment Advice" showing historical crashes and recoveries adjusted for inflation.

#2 Active Trading

Another approach to trading in bear markets is to actively trade the prevailing direction. As mentioned above, the problem with this approach is that it requires timing the market and this is not easy to do. Markets are forward looking and do not always act in an obvious manner. If you guess wrong on the direction you will not only lose money, but you will miss out on growth opportunities. See the chart below courtesy of HighCharts.com showing that markets can often move very quickly without giving very much time to react. The sum of the 5 best trading days of the year can often make up for most of the yearly profit. Missing out on these days would be devistating to a growth trader.

85% of pro traders are unable to time the market. But what about the other 15%? Market timers can get the best of both worlds if they are able to time the market correctly. Hedge fund manager Bill Ackman famously made 2.6 Billion dollars on trades during the coronavirus. Then abruptly switched directions and started buying stocks again. Methods such as shorting stocks, put options, and negative ETFs are 3 ways one can trade in the opposite direction. Each of these can be very risky if you don't get it right. In addition, there is another way. If shorting is not your thing, change from the stock market to another market such as FOREX. In FOREX, you can easily trade in either direction. As long as there is movement, there are trading oportunities. During January 1st, 2024, while the rest of the markets were going no where, Dreamfire52 accounts rose by over 10% bringing the total verified gains to -19.18% since January 1st, 2024

To understand the Dreamfire52 "Passive Income - Double Your Money Challenge". See the Dreamfire52 home page or watch the short video below.